Payment Flows

Trustmi’s solution helps automate payment run verification, validation and approvals, detect vulnerabilities, fraud and errors, to ensure vendors are paid accurately and on time.

The procure-to-pay process is highly complex, involving thousands of vendors, multiple systems, siloed teams, and rigid procedures—leading to errors, fraud, and inefficiencies.

2.5%

Avg of budgets lost to payment errors per year

(source: IFOL)

SOLUTION

How Trustmi Eliminates Payment Fraud and Errors So You Can Transact with Confidence

SOLUTION

How Trustmi Eliminates Payment Fraud and Errors So You Can Transact with Confidence

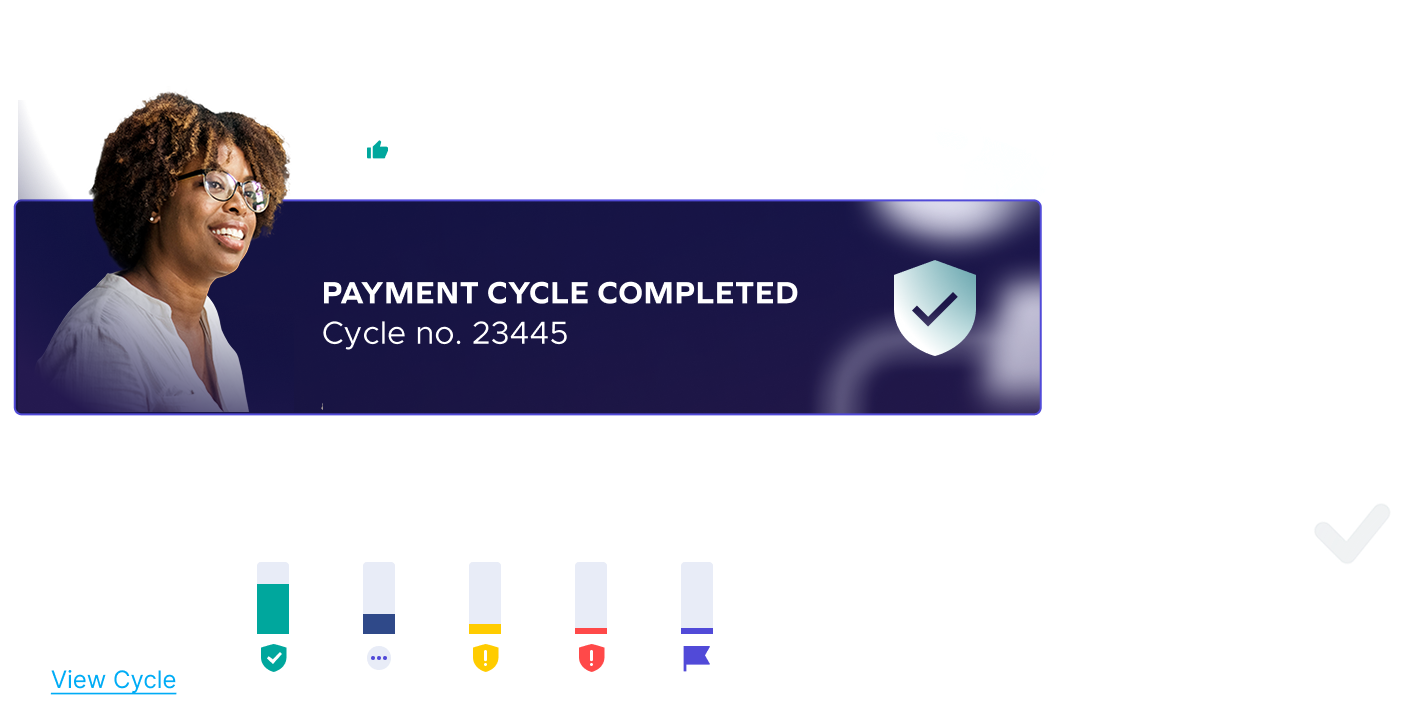

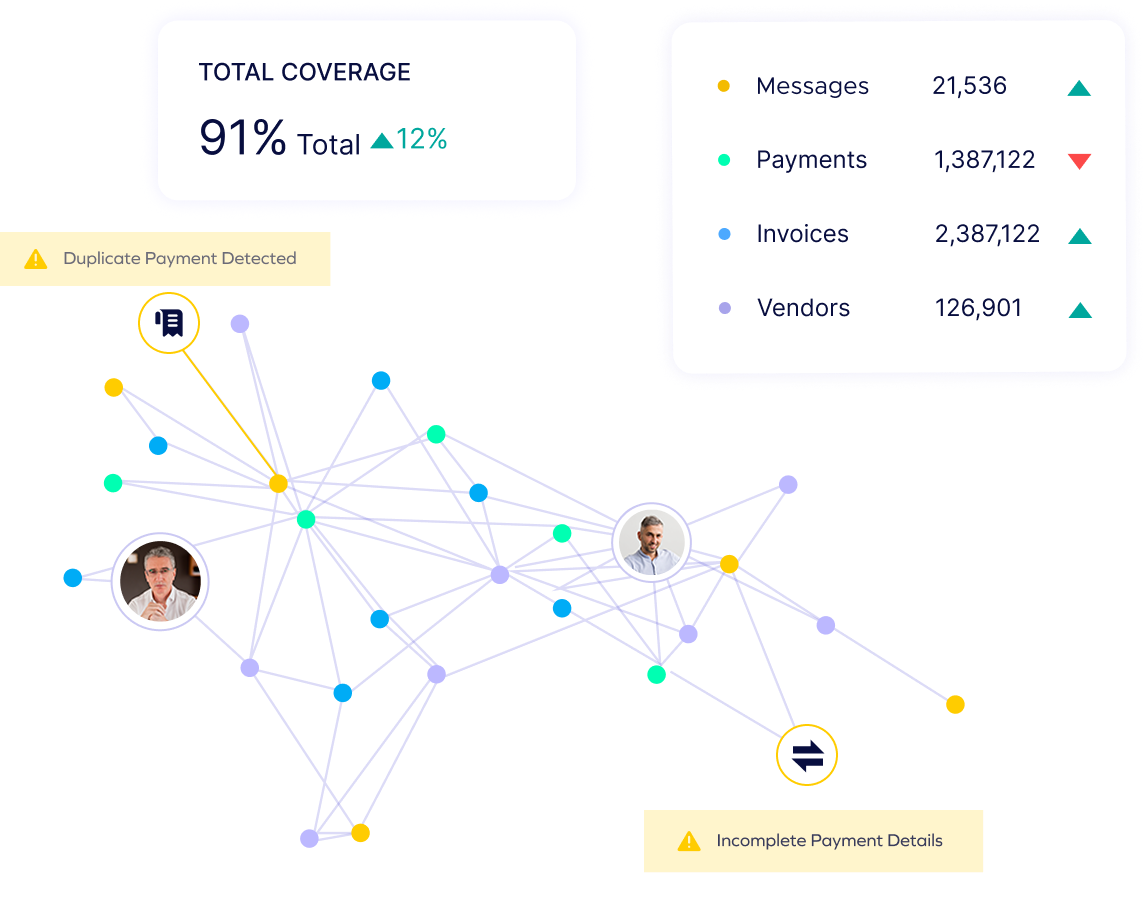

Automated Payment Fraud & Error Protection

Eliminates fraud and payment errors by detecting anomalies in real time. Prevents duplicate, late, or mismatched payments while reducing manual intervention and ensuring transactions are accurate and secure.

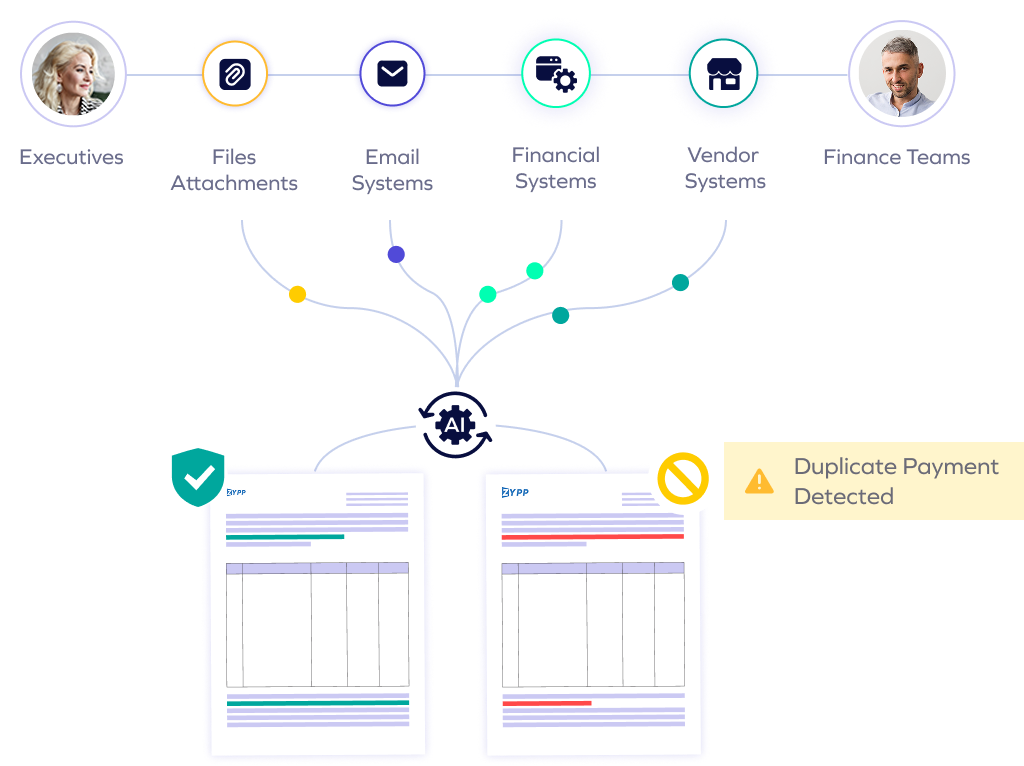

Comprehensive Behavioral AI

Leverages AI to detect unusual patterns in payment flows, flagging suspicious transactions caused by fraud or human error. Identifies unauthorized approvals, altered payment details, and out-of-policy payments before they cause financial loss.

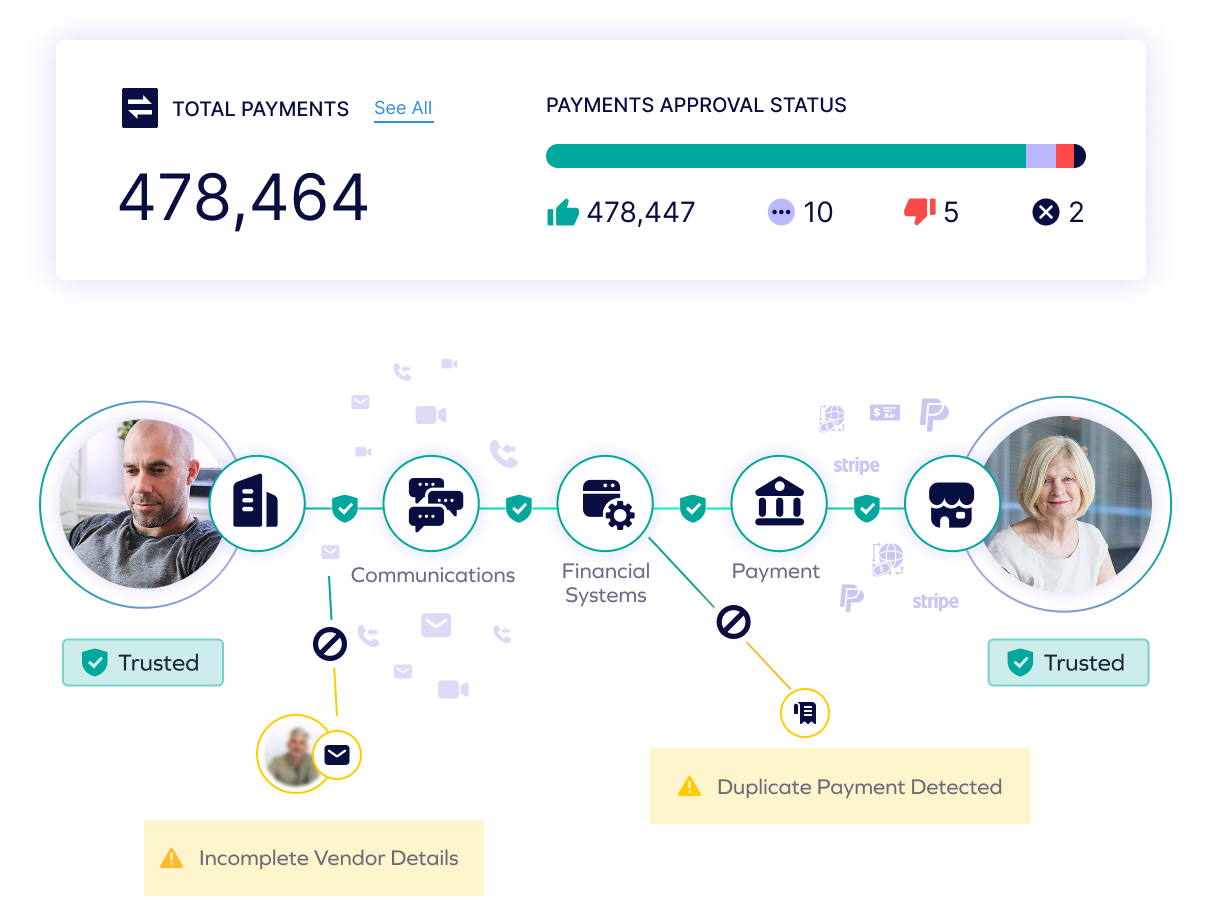

Real-Time Data Correlation

Continuously validates payment details across email, ERP, and financial systems to catch discrepancies. Flags duplicate invoices, mismatched vendor information, incorrect amounts, and late payments to prevent costly errors.

Seamless Process Integration

Integrates effortlessly with payment, email, and ERP systems to streamline approvals and close operational gaps. Automates reconciliation, fraud detection, and error prevention without disrupting your business.

Trusted by Finance and Security Leaders

"Trustmi provided transparency into our payment process to see where cyberattacks and errors were happening and full protection without changing our workflow."

"Like many businesses today, we've experienced cyber attacks on our payment process, but we didn't realize the extent to which we were at risk until we evaluated Trustmi. Now we're confident we'll be able to avoid future attacks with their platform."

"Trustmi's platform is an important tool for our team. Their Payment Flows module increases our payment cycle security, and our team has also managed to cut down the time for preparing payments reports from half a day to half an hour."