Eliminate Costly Human Errors From Payments

The problem

Payment errors create financial losses, operational bottlenecks, and reputational risks

Payment operations errors create systemic inefficiencies that ripple through financial systems, supply chains, and customer relationships.

The challenge

Manual data entry errors, disconnected systems, or duplicate vendor records can lead to multiple payments for the same invoice, costing enterprises millions annually.

Supplier fraud, weak validation controls, and rushed approvals erode 1–2% of annual spend and trigger prolonged vendor disputes.

Technical glitches, system mismatches, lack of coordination, and manual processes cause payment failures, leading to delays and financial losses.

The solution

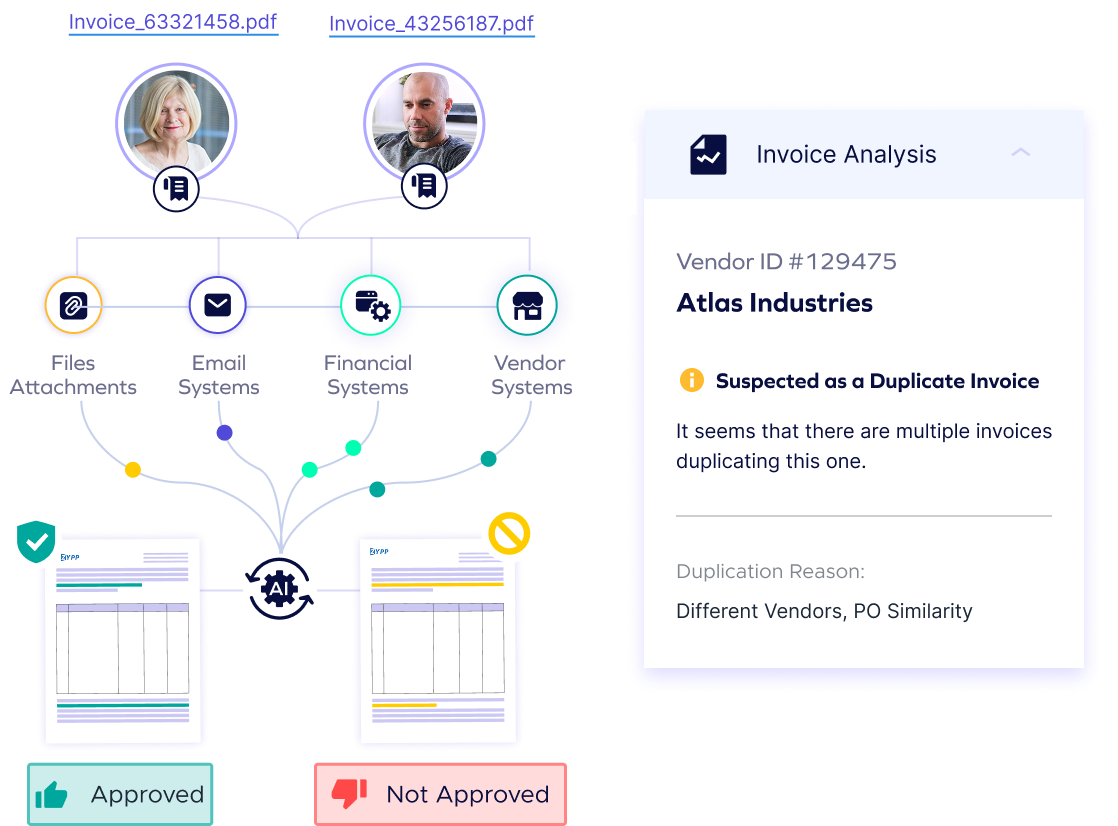

Identifies and blocks anomalies, duplicate invoices, and fraudulent attempts before payments are processed, reducing errors by 90% and saving millions annually.

Automatically enforces approval rules, streamlines payment validation, and enhances vendor onboarding verification, reducing manual errors exploited in social engineering schemes.

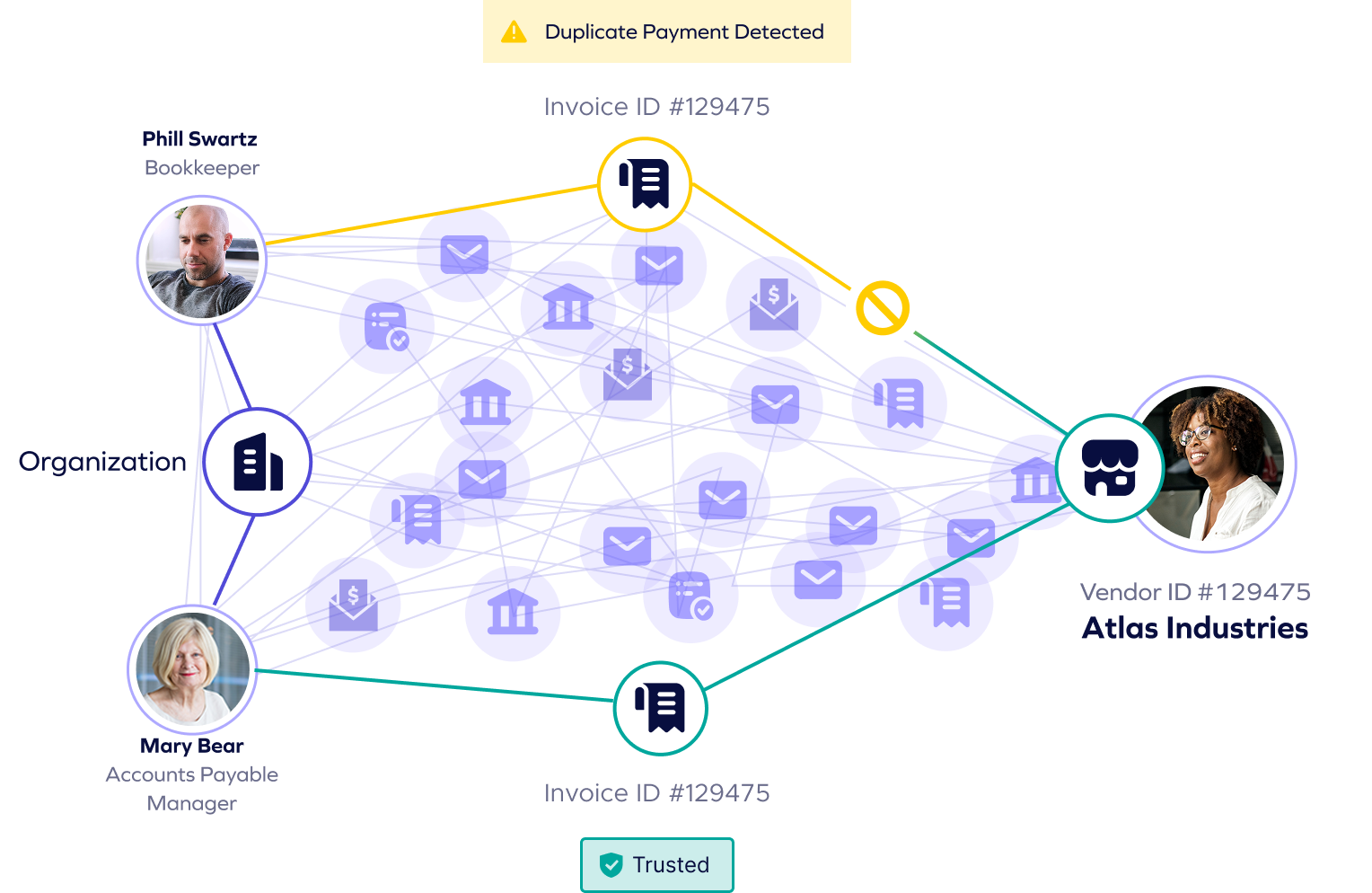

Payment Digital Fingerprinting creates unique payment profiles by analyzing hundreds of data points (e.g., invoice patterns, communication history) to detect anomalies such as duplicate invoices, sudden payment amount changes, and invoices submitted outside a vendor’s typical billing cycle.

our approach

Eliminate Payment Errors with Trustmi

Trustmi delivers a centralized, fully automated solution that safeguards the entire B2B payment lifecycle, proactively addressing the root cause of financial fraud—socially engineered cyberattacks—while reducing manual effort and errors.

Trustmi pulls data from various financial systems and combines it with other critical data points to validate transactions in real time, stopping fraud attempts stemming from social engineering before they cause harm.

Trustmi analyzes patterns across vendors, payment data, emails, and financial documents, detecting sophisticated social engineering tactics and ensuring holistic fraud detection beyond limited channels.

Trustmi seamlessly integrates with your payment ecosystem, ensuring uninterrupted operations while delivering robust protection against socially engineered cyberattacks targeting your payments.

Trusted by Finance and Security Leaders

"Trustmi provided transparency into our payment process to see where cyberattacks and errors were happening and full protection without changing our workflow."

"Like many businesses today, we've experienced cyber attacks on our payment process, but we didn't realize the extent to which we were at risk until we evaluated Trustmi. Now we're confident we'll be able to avoid future attacks with their platform."

"Trustmi's platform is an important tool for our team. Their Payment Flows module increases our payment cycle security, and our team has also managed to cut down the time for preparing payments reports from half a day to half an hour."