The One Platform to Eliminate Socially Engineered Attacks and Human Errors

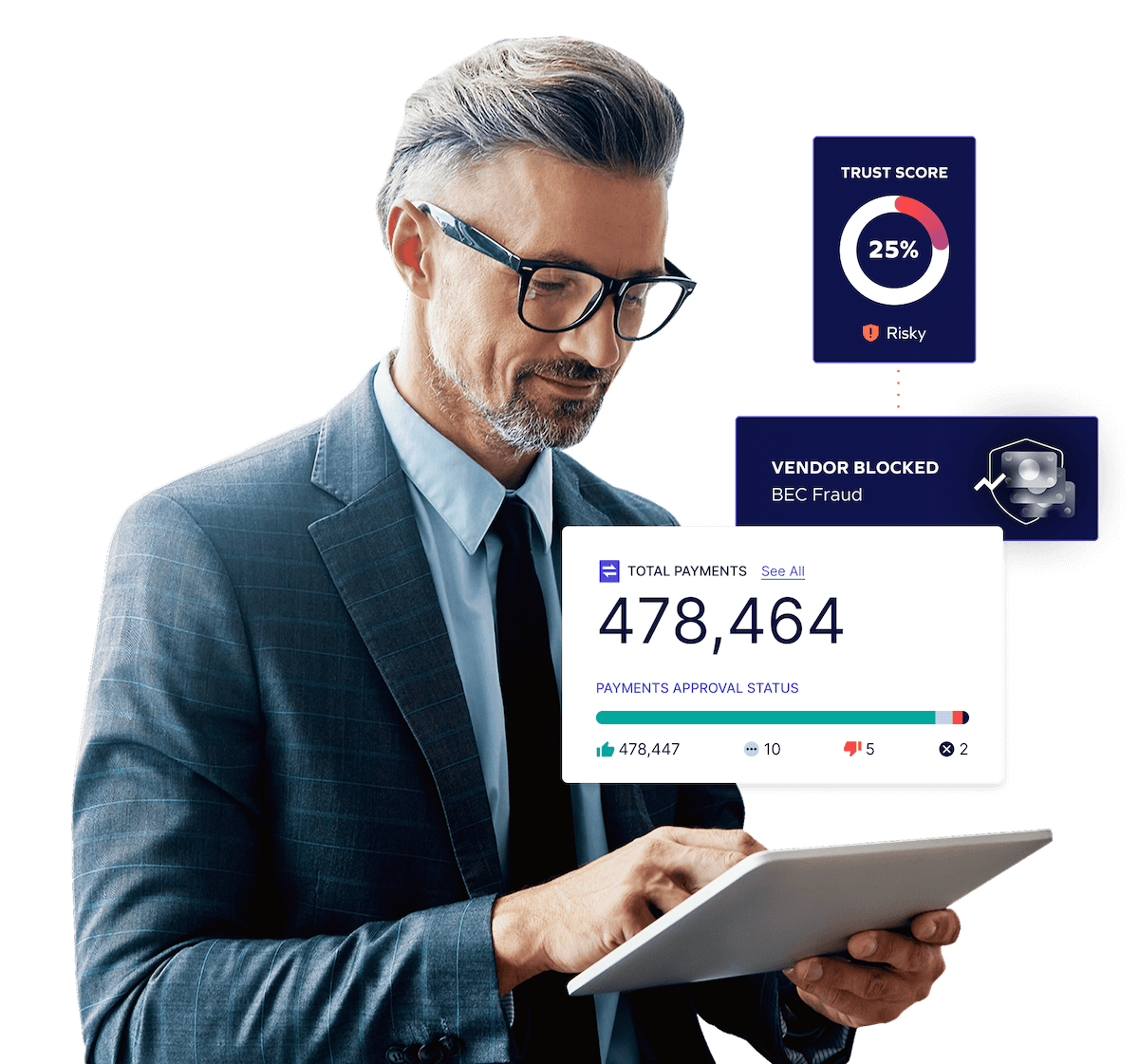

Trustmi’s behavioral AI connects the dots across emails, payments, and vendors to uncover advanced fraud, detect human errors, and safeguard your organization’s money in real-time.

Purpose-Built for Security and Finance

Detect Anomalies. Eliminate Threats. Protect Your Bottom Line.

Social engineering attacks and human errors are among the most damaging threats to organizations, costing billions each year. Trustmi is specifically designed for security and finance teams, leveraging advanced behavioral AI to detect anomalies, prevent fraud, and ensure financial integrity. Our end-to-end, real-time protection safeguards your business’s bottom line, people, and processes from sophisticated threats.

Purpose-Built for Security and Finance

Detect Anomalies. Eliminate Threats. Protect Your Bottom Line.

Social engineering attacks and human errors are among the most damaging threats to organizations, costing billions each year. Trustmi is specifically designed for security and finance teams, leveraging advanced behavioral AI to detect anomalies, prevent fraud, and ensure financial integrity. Our end-to-end, real-time protection safeguards your business’s bottom line, people, and processes from sophisticated threats.

SOLUTION

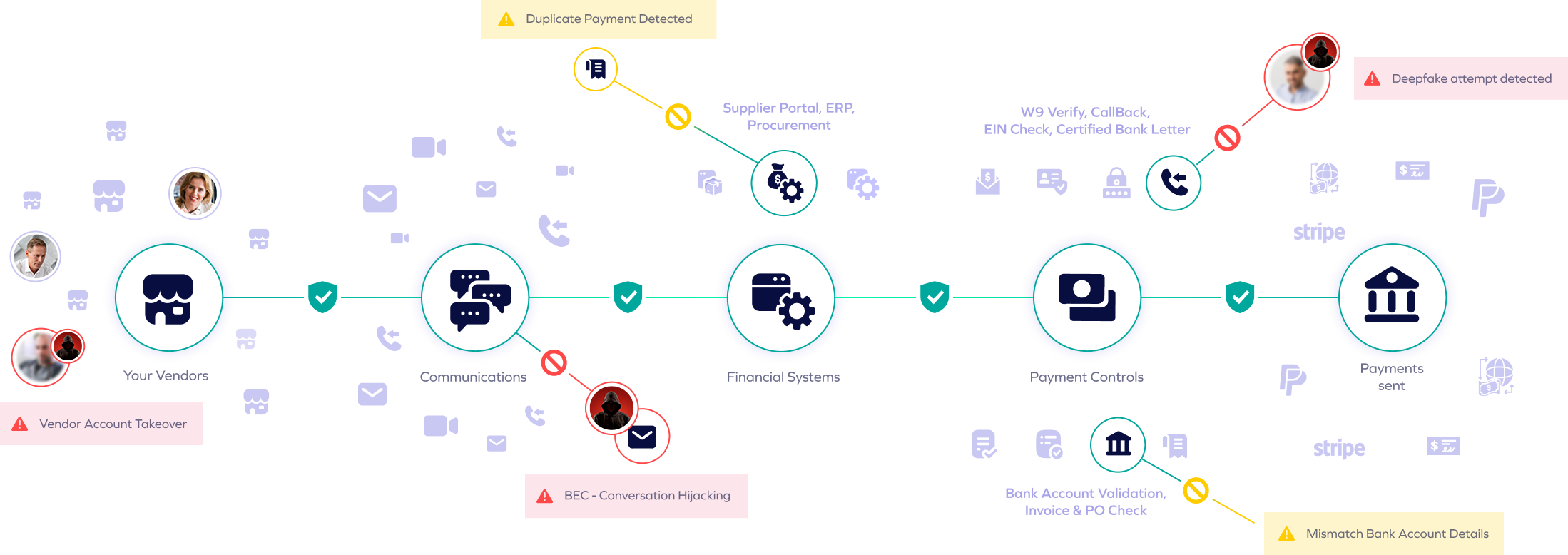

How Trustmi’s Platform Eliminates

Socially Engineered Attacks and Human Errors

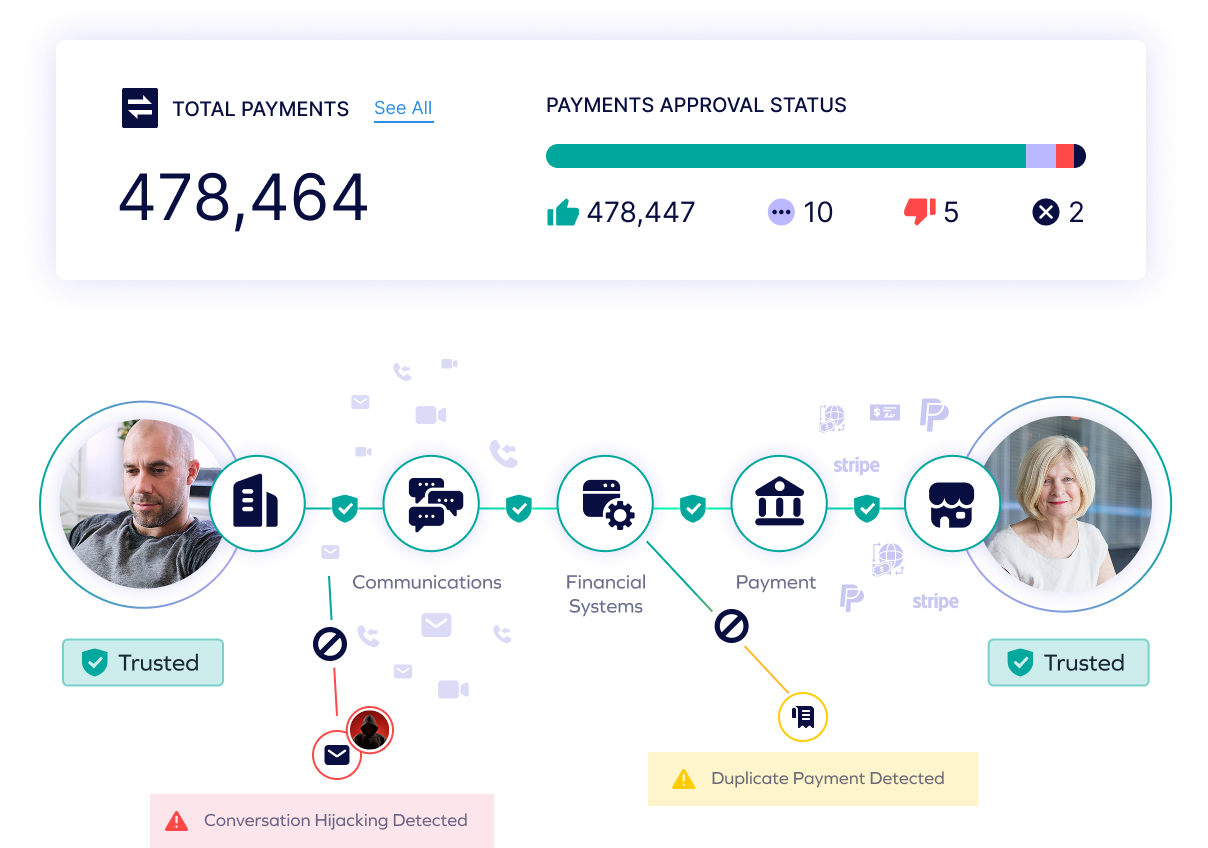

Automated Payment Fraud Protection

Trustmi fully automates payment security, eliminating fraud, errors, and manual effort. Instantly stopping unauthorized payments and streamline workflows to protect your business’s bottom line.

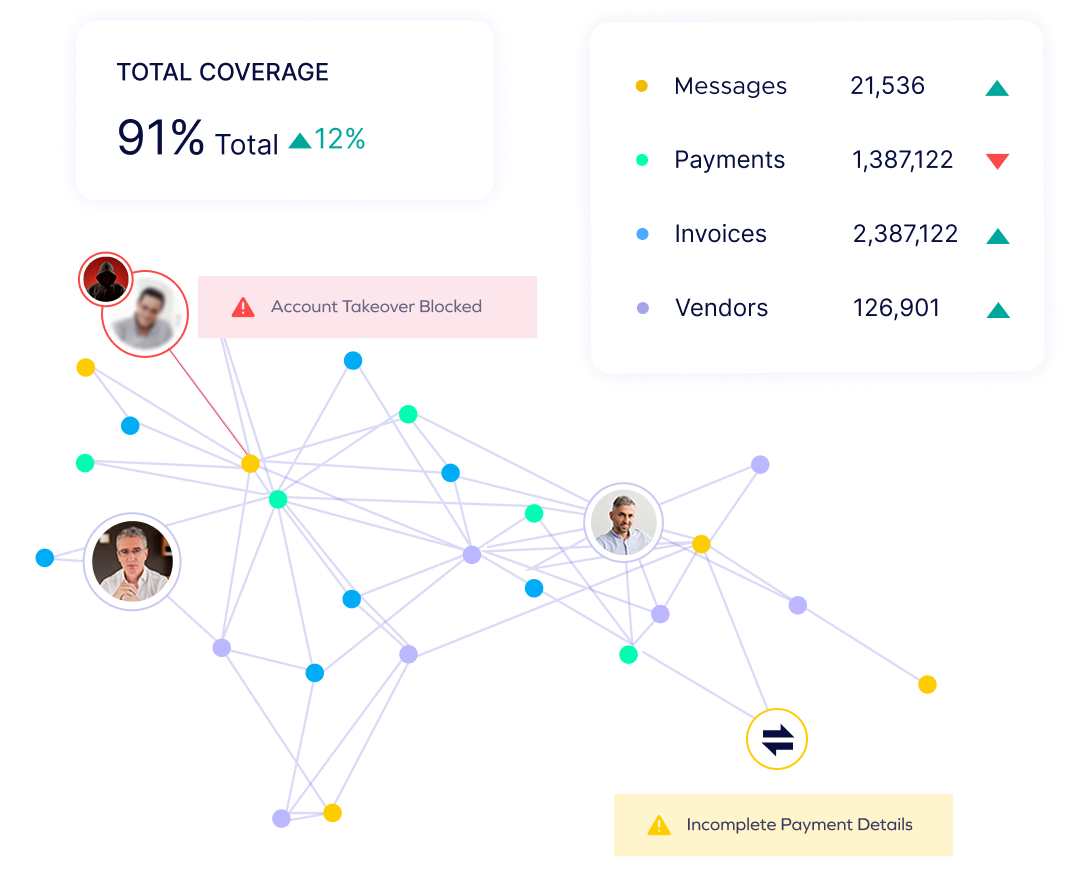

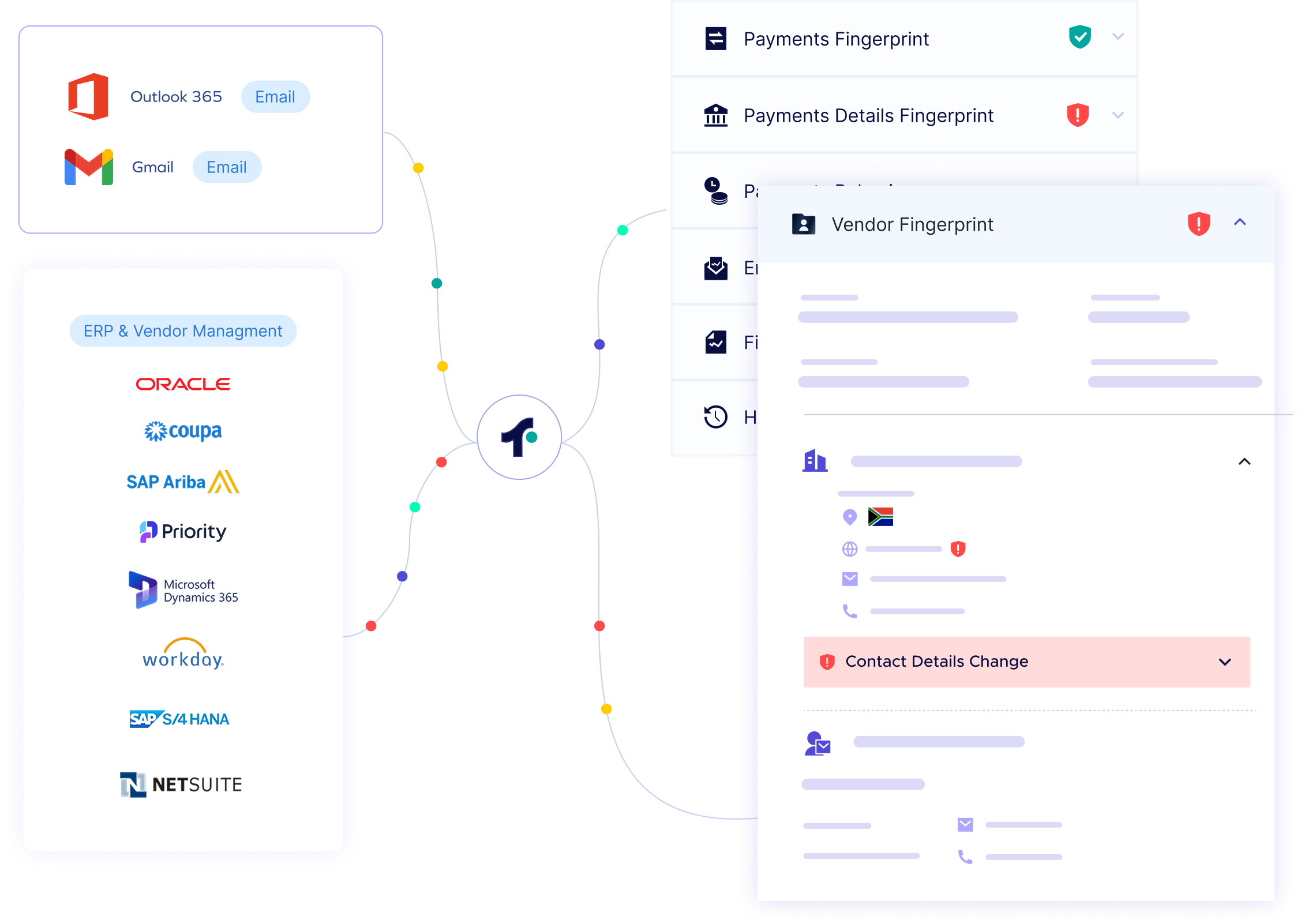

Comprehensive Behavioral AI

Trustmi’s advanced AI detects fraud and errors by analyzing patterns across vendors, employees, and transactions. Prevent sophisticated threats with unmatched precision.

End-to-End Risk Visibility

Integrates data across your entire financial ecosystem to provide a unified view of potential risks, preventing social engineering attacks, invoice fraud, and unauthorized transactions.

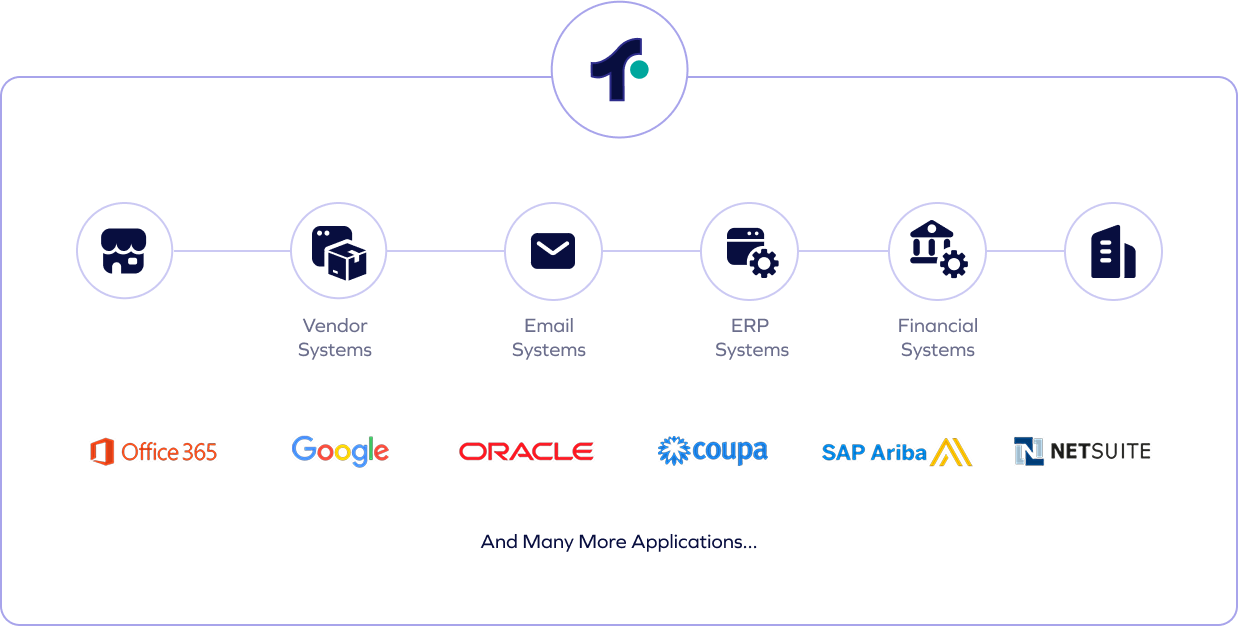

Seamless Process Integration

Integrate Trustmi easily into your existing workflows, from email to financial tools, without disrupting operations.

Trusted by Finance and Security Leaders

"Trustmi provided transparency into our payment process to see where cyberattacks and errors were happening and full protection without changing our workflow."

"Like many businesses today, we've experienced cyber attacks on our payment process, but we didn't realize the extent to which we were at risk until we evaluated Trustmi. Now we're confident we'll be able to avoid future attacks with their platform."

"Trustmi's platform is an important tool for our team. Their Payment Flows module increases our payment cycle security, and our team has also managed to cut down the time for preparing payments reports from half a day to half an hour."