Eliminate Financial Fraud driven by Trusted App Scams

THE PROBLEM

Trusted Apps, Exploited: How Attackers Turn Legitimate Tools Into Threats

Fraudsters hijack trusted apps like DocuSign and Microsoft 365 to bypass security and manipulate payments. Without a connected view of app activity and payment workflows, these attacks go undetected.

THE CHALLENGE

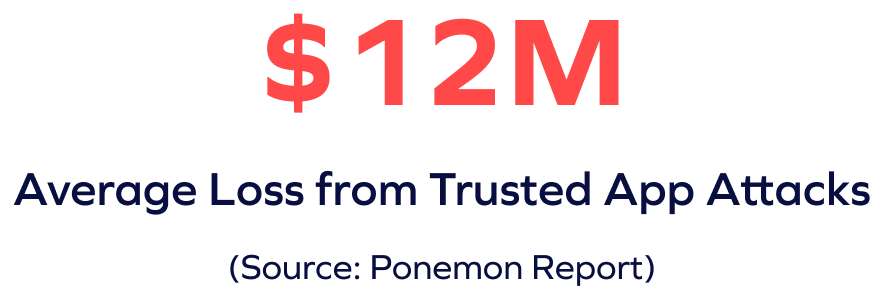

Trusted app attacks often involve authorized user interactions, making them hard to pinpoint among normal activities.

Most often, fraudulent transfers are irreversible, forcing organizations to rely on preemptive detection.

Lack of robust integration, incomplete API security, and reliance on legacy tools, leave systems vulnerable to API manipulation, and undetected AI-driven threats.

THE SOLUTION

Analyzes API transaction patterns to detect malicious activity in platforms like DocuSign. Blocks unauthorized requests and suspicious envelope creation patterns.

Establishes vendor-specific baselines by analyzing historical payment data, communications, and profile changes. Flags deviations and anomalies with 0% false positives.

Actively safeguard key accounts such as finance, executives, and vendor-facing roles, where fraud impacts are most severe.

our approach

Eliminate Trusted App Attacks with Trustmi

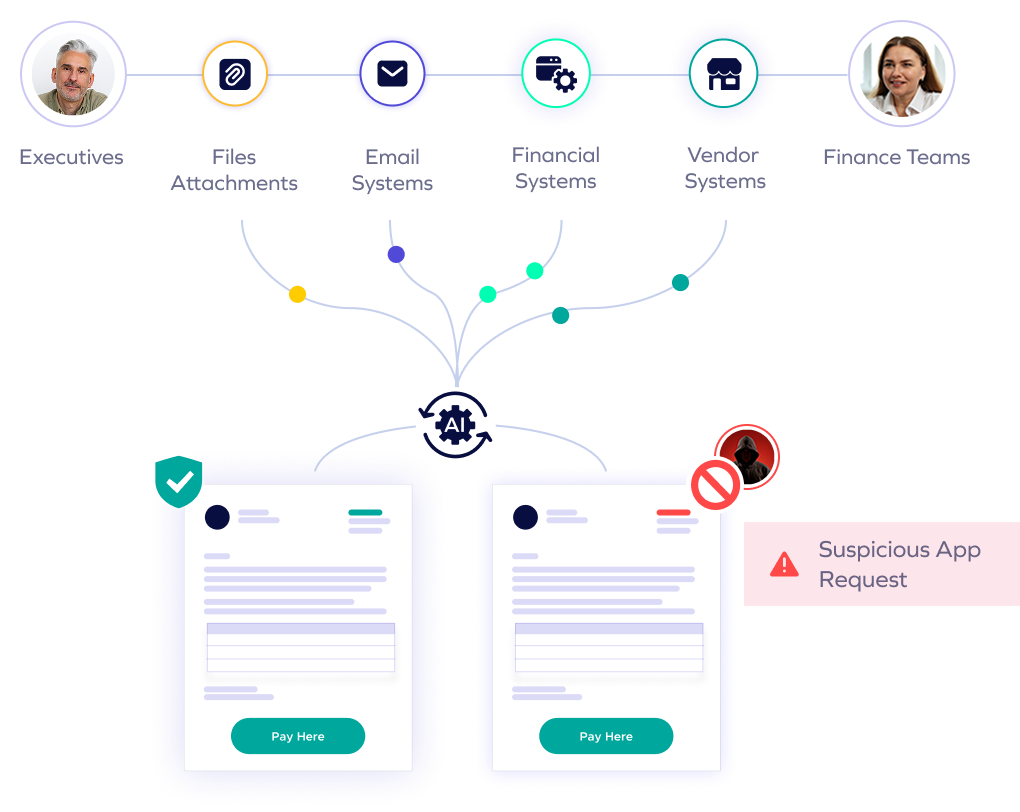

Trustmi delivers a centralized, fully automated solution that safeguards the entire B2B payment lifecycle, proactively addressing the root cause of financial fraud—socially engineered cyberattacks—while reducing manual effort and errors.

Trustmi pulls data from various financial systems and combines it with other critical data points to validate transactions in real time, stopping fraud attempts stemming from social engineering before they cause harm.

Trustmi analyzes patterns across vendors, payment data, emails, and financial documents, detecting sophisticated social engineering tactics and ensuring holistic fraud detection beyond limited channels.

Trustmi seamlessly integrates with your payment ecosystem, ensuring uninterrupted operations while delivering robust protection against socially engineered cyberattacks targeting your payments.

Trusted by Finance and Security Leaders

"Trustmi provided transparency into our payment process to see where cyberattacks and errors were happening and full protection without changing our workflow."

"Like many businesses today, we've experienced cyber attacks on our payment process, but we didn't realize the extent to which we were at risk until we evaluated Trustmi. Now we're confident we'll be able to avoid future attacks with their platform."

"Trustmi's platform is an important tool for our team. Their Payment Flows module increases our payment cycle security, and our team has also managed to cut down the time for preparing payments reports from half a day to half an hour."