Eliminate Financial Fraud From Business Email Compromise

THE PROBLEM

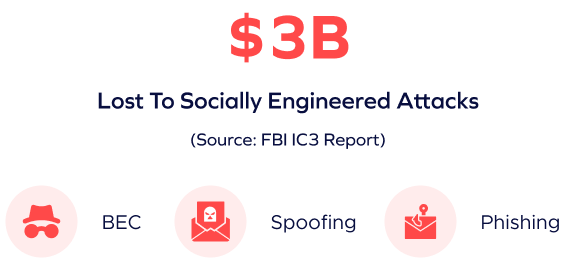

BEC is the costliest threat in cyber security.

Socially engineered email attacks exploit human trust, bypassing security filters to impersonate executives, vendors, or partners. By deceiving employees, they manipulate payment approvals, leading to financial loss and data breaches.

THE CHALLENGE

Clean accounts, well-timed emails, and convincing impersonations of trusted individuals bypass detection and manipulate employees, making fraud nearly indistinguishable from legitimate communication.

Fake invoices, wire requests, and pressure-driven urgency exploit trust and can force unverified decisions.

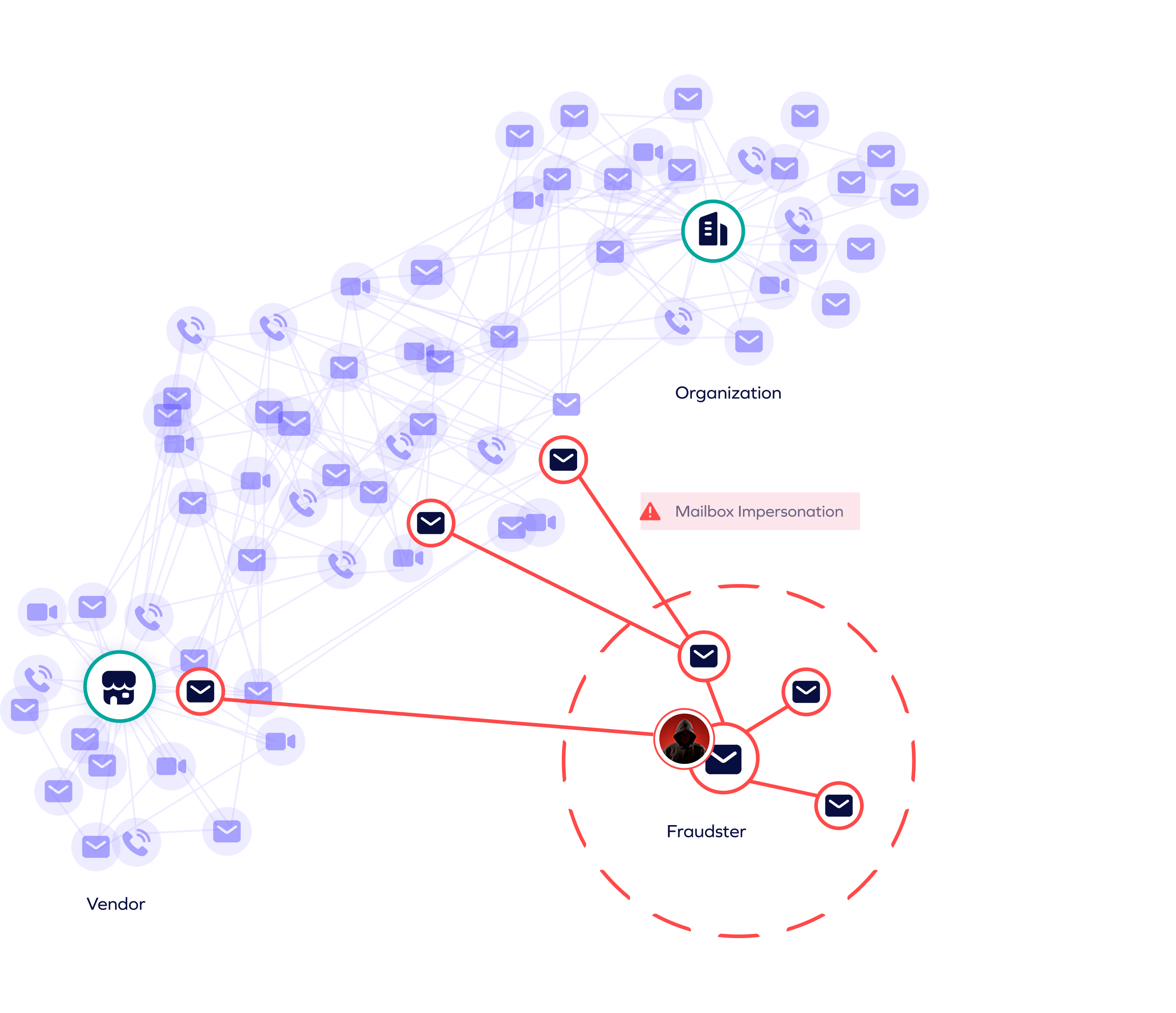

Overloaded models process too much noise, missing high-priority threats. Generic detection overlooks finance-specific fraud, while limited financial data integration fails to catch payment anomalies.

THE SOLUTION

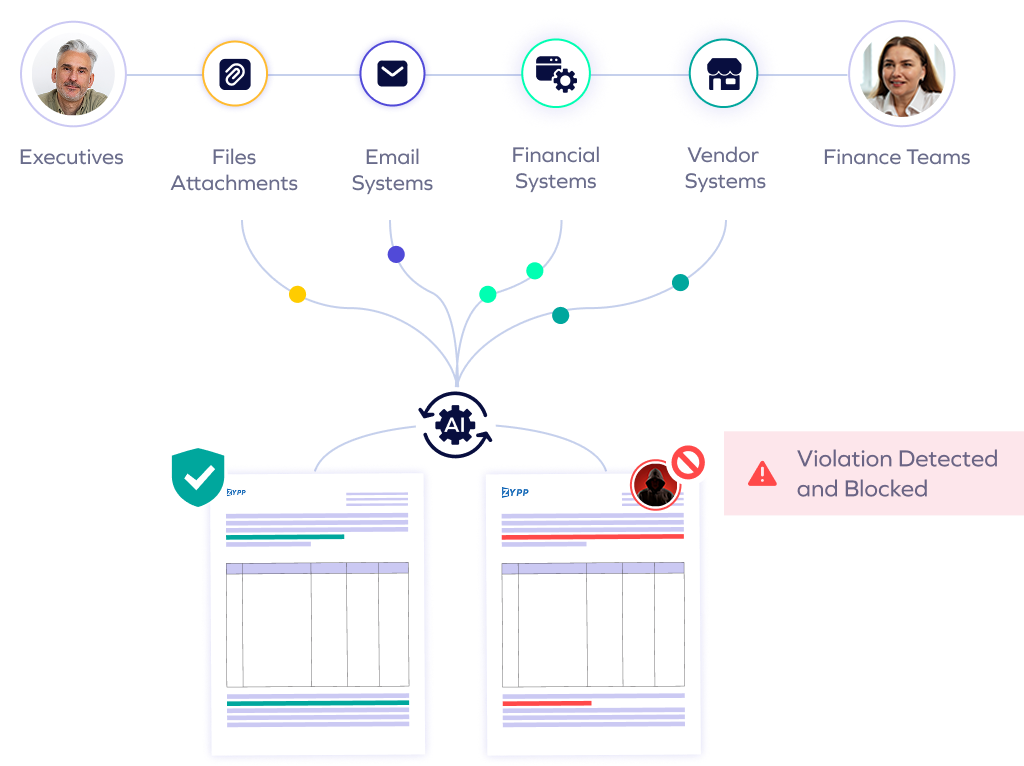

Actively safeguard key roles in finance, executive leadership, and vendor management, where access to funds, the ability to make changes and approve payments make fraud most damaging.

Correlate vendor, payment, and employee behavioral insights to improve fraud detection accuracy while minimizing false positives.

Stay ahead of advanced and never-before-seen social engineering attacks, including deep fakes, executive impersonation, and trusted app scams, with real-time monitoring and model adaptation—preventing fraud before it impacts your bottom line.

our approach

Eliminate Business Email Compromise with Trustmi

Trustmi delivers a centralized, fully automated solution that safeguards the entire B2B payment lifecycle, proactively addressing the root cause of financial fraud—socially engineered cyberattacks—while reducing manual effort and errors.

Trustmi pulls data from various financial systems and combines it with other critical data points to validate transactions in real time, stopping fraud attempts stemming from social engineering before they cause harm.

Trustmi analyzes patterns across vendors, payment data, emails, and financial documents, detecting sophisticated social engineering tactics and ensuring holistic fraud detection beyond limited channels.

Trustmi seamlessly integrates with your payment ecosystem, ensuring uninterrupted operations while delivering robust protection against socially engineered cyberattacks targeting your payments.

Trusted by Finance and Security Leaders

"Trustmi provided transparency into our payment process to see where cyberattacks and errors were happening and full protection without changing our workflow."

"Like many businesses today, we've experienced cyber attacks on our payment process, but we didn't realize the extent to which we were at risk until we evaluated Trustmi. Now we're confident we'll be able to avoid future attacks with their platform."

"Trustmi's platform is an important tool for our team. Their Payment Flows module increases our payment cycle security, and our team has also managed to cut down the time for preparing payments reports from half a day to half an hour."