Eliminate Cyber Fraud caused by Executive Impersonation

THE PROBLEM

Gen AI Fuels More Frequent, Sophisticated Executive Impersonation Attacks

Socially engineered impersonation attacks have become increasingly prevalent and costly, posing a severe threat to businesses across various industries.

THE CHALLENGE

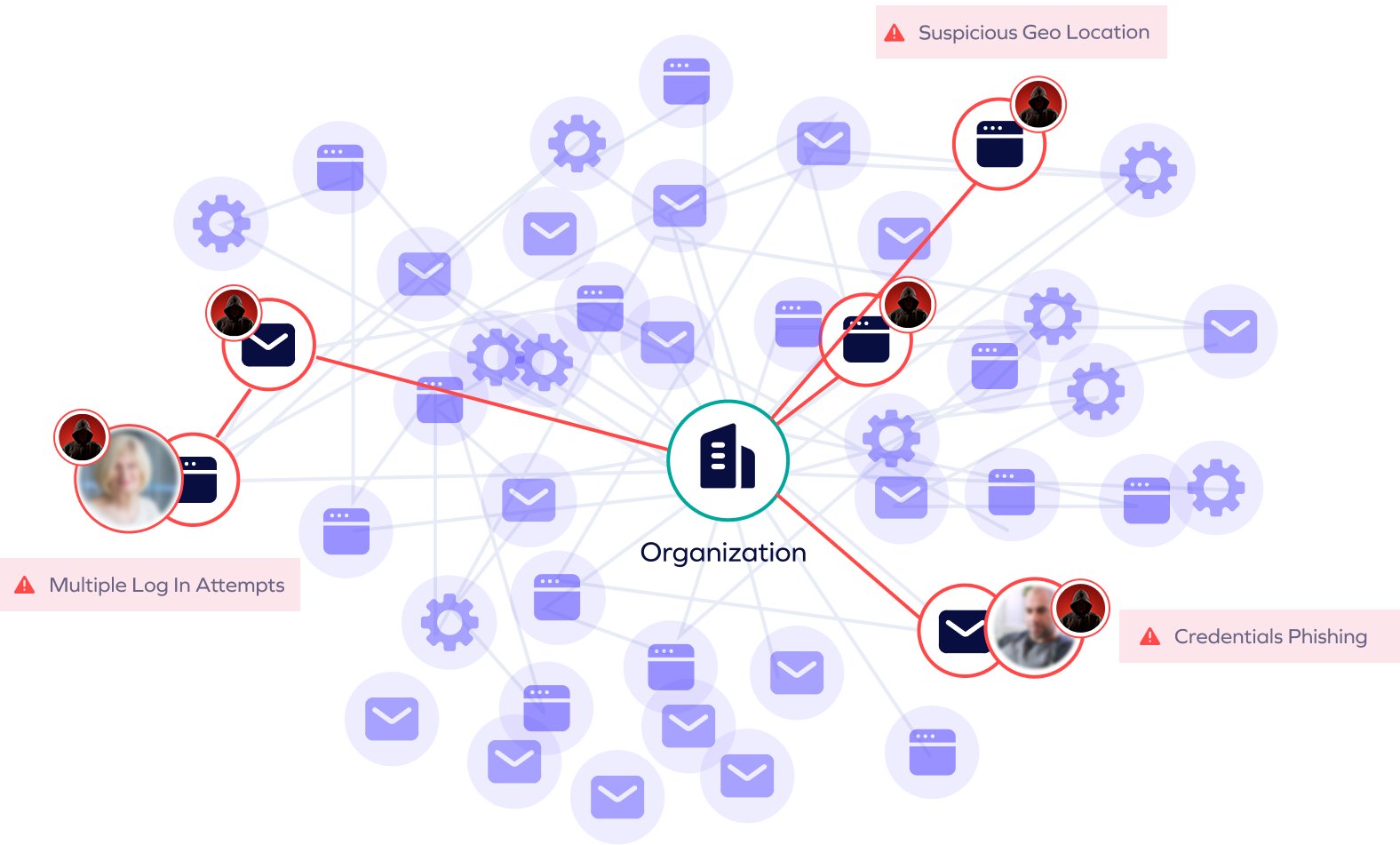

Impersonation schemes often involve urgent, confidential wire transfer requests. Attackers use spoofed emails that mimic executive accounts with subtle domain changes and multi-channel attacks that combine fake emails with follow-up calls or texts to pressure employees.

Human vulnerability remains a major weakness in payment security, with 50% of fraud cases caused by employee errors, often due to pressure. The lack of automation and the rise of remote work increase risks by limiting in-person verification.

Fraudsters now use artificial intelligence to mimic executives’ voices, facial expressions, and communication styles with alarming accuracy. These attacks bypass traditional red flags, such as typos in emails, and exploit employees’ trust in authority figures.

THE SOLUTION

Machine learning models flag communication inconsistencies and provide real-time alerts for suspicious activities, such as urgent payment requests from executives.

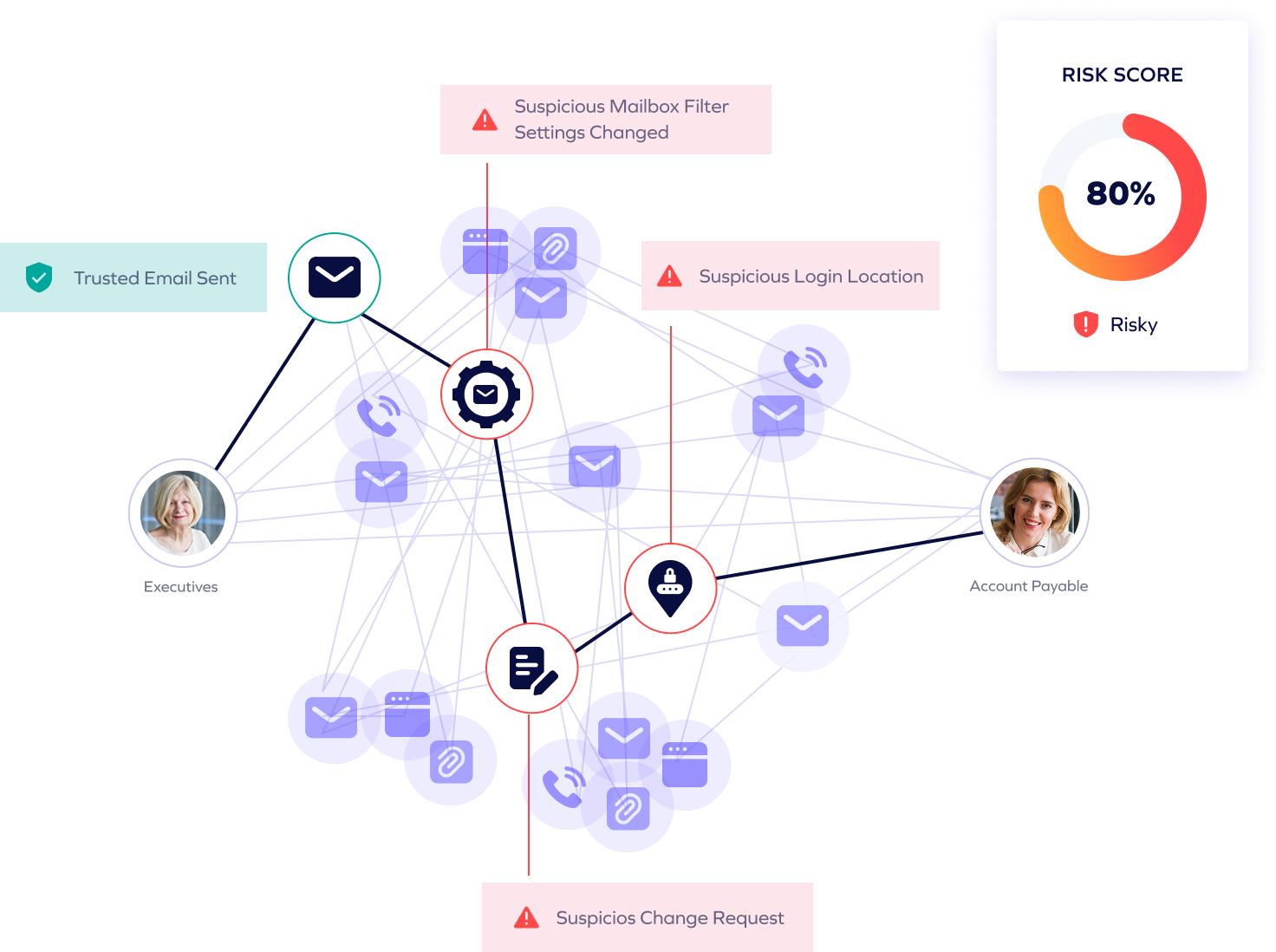

Monitors all payment communications to detect spoofed emails and look-alike domains. Enforces segregation of duties, preventing employees from bypassing controls in response to urgent executive requests.

Establishes a baseline “digital fingerprint” for each user based on historical data and communication patterns, flagging deviations.

our approach

Outsmart Executive Impersonation with Trustmi

Trustmi delivers a centralized, fully automated solution that safeguards the entire B2B payment lifecycle, proactively addressing the root cause of financial fraud—socially engineered cyberattacks—while reducing manual effort and errors.

Trustmi pulls data from various financial systems and combines it with other critical data points to validate transactions in real time, stopping fraud attempts stemming from social engineering before they cause harm.

Trustmi analyzes patterns across vendors, payment data, emails, and financial documents, detecting sophisticated social engineering tactics and ensuring holistic fraud detection beyond limited channels.

Trustmi seamlessly integrates with your payment ecosystem, ensuring uninterrupted operations while delivering robust protection against socially engineered cyberattacks targeting your payments.

Trusted by Finance and Security Leaders

"Trustmi provided transparency into our payment process to see where cyberattacks and errors were happening and full protection without changing our workflow."

"Like many businesses today, we've experienced cyber attacks on our payment process, but we didn't realize the extent to which we were at risk until we evaluated Trustmi. Now we're confident we'll be able to avoid future attacks with their platform."

"Trustmi's platform is an important tool for our team. Their Payment Flows module increases our payment cycle security, and our team has also managed to cut down the time for preparing payments reports from half a day to half an hour."