What’s the cost of socially engineered fraud for your business?

Yes, there’s the money stolen—now surging to 100 billion with GenAI-powered payment fraud. But that’s only part of the story.

The bigger hit is a hidden finance tax: the hours AP, procurement, and analysts lose to manual reviews, redundant checks, and second-guessing payments. Every false alarm steals time from strategic work, draining productivity, and weakening working capital efficiency.

It’s time for finance leaders to start measuring—and cutting—this hidden socially engineered fraud tax.

The Rising Cost of GenAI Social Engineering

The challenge is that Gen-AI is multiplying and perfecting the problem at scale. For example, why did a CFO’s team recently flag an invoice?

Because it was too perfect.

That CFO was Tomer Amitai of Natural Intelligence, who joined this conversation alongside security leader Irina Singh of Baxter. Together, they compared notes on how fraud is evolving—and what it means for finance and security teams.

As Tomer explained, “the invoice passed through all of our checks until it was flagged because it was too perfect.” What used to be easy to spot—broken English, odd formatting, fake-looking bank letters—has been replaced by AI-polished fraud that looks and feels real.

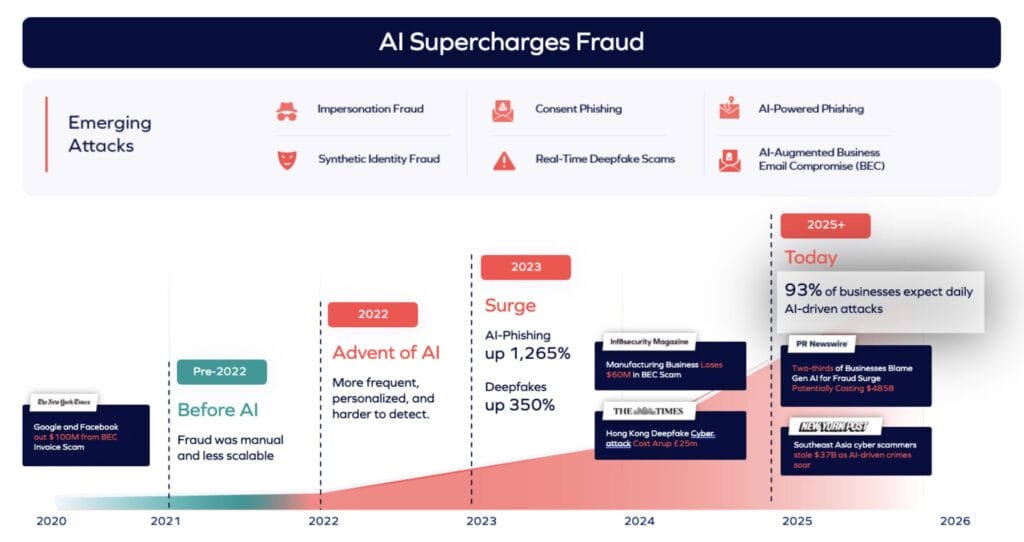

And that number of perfection has exploded, thanks to GenAI. AI-generated phishing attacks surged more than 1,200% last year, and deepfake-enabled fraud attempts climbed 350%. For finance leaders, that means more volume, more credibility, and more work. Every attempt now forces analysts, AP, and procurement into longer reviews and deeper checks.

The Productivity Toll Inside Finance Teams

So what’s the cost of all this time? Well, most fraud research focuses on stolen dollars. But the 2025 Trustmi Finance & Cybersecurity Fraud Survey offers rare visibility into the hidden productivity tax, by surveying finance and security leaders at $1B+ enterprises.

When asked to identify the most significant impact of fraud incidents, respondents ranked operational disruption (52.6%) even higher than financial impact (42.6%). And the problem is frequent: more than half said fraud attempts or incidents disrupt their teams monthly or more, with 10.9% reporting weekly disruptions.

This is where organizations fall short. Fraud “losses” usually show up in reports only when money leaves the door. That ignores the hidden costs of duplicate reviews, repeated callbacks, and delayed processes.If AP spends 20% of its time on duplicate fraud checks, that’s the equivalent of losing two FTEs on a 10-person team—a hidden labor expense that drags on operating margin.

The impact doesn’t stop there. Slower reconciliations stretch reporting cycles. Delayed or disputed payments strain vendor trust. Extended approvals reduce working capital efficiency. These balance sheet effects rarely appear under “fraud losses” but are just as real.

For CFOs, this isn’t background noise. It is labor cost leakage, a hidden line item quietly eroding margins and slowing the business.

Why It Happens: Fragmentation and Misalignment

The productivity drain isn’t just the result of more Gen-AI scaling more flawless fraud attempts. It’s also built into the way finance and security operate today.

As CFO Tomer Amitai noted, signals are often there, but buried in technical data, routed to the wrong place, or handled twice by different teams.

Irina Singh described the same problem from the other side. Many financial systems, she explained, don’t connect into security monitoring tools. That leaves incident responders without the context to know which alerts tie directly to money movement—forcing both teams to chase the same issues separately.

The outcome is predictable:

- Fragmented systems leave finance and security working in parallel on the same risks.

- Context gaps cause red flags to be missed or checked multiple times.

- Overconfidence in tools creates a false sense of security, while finance teams keep backstopping with manual work.

The 2025 Trustmi Finance & Cybersecurity Fraud Survey confirms how pervasive this misalignment is. When asked how often finance and security teams have visibility into each other’s incidents, only 27% said always, while 46% said sometimes, 14% rarely, and 5% never. In other words, nearly three-quarters of leaders admit they don’t always have consistent visibility—leaving plenty of opportunity for gaps, duplication, or missed signals.

The Cost Finance Leaders Can’t Ignore

CFOs already track DSO, working capital, OPEX, and operating margin. Yet when it comes to fraud, the most significant costs often go unmeasured.

That’s why CFO Tomer Amitai has made it a priority: “We implement measures to quantify loss control—not just headlines of risks and mitigations, but how fraud losses and attempts reduce over time as a joint KPI.”

His point is simple: if you don’t measure it, you can’t manage it. Finance leaders need to put fraud’s hidden tax on the dashboard, alongside the rest of their core metrics. And they need to work with CISOs to cut duplication and reclaim efficiency.

Watch the on-demand webinar with CFO Tomer Amitai and IT leader Irina Singh to learn how finance and security teams are cutting fraud’s hidden tax and driving ROI.