Eliminate Cyber Fraud caused by Account Takeover (ATO)

THE PROBLEM

Account Takeover Fraud Costs Billions Every Year

Account takeovers drain billions from businesses each year, exploiting stolen credentials and phishing to bypass security and authorize fraudulent transactions.

THE CHALLENGE

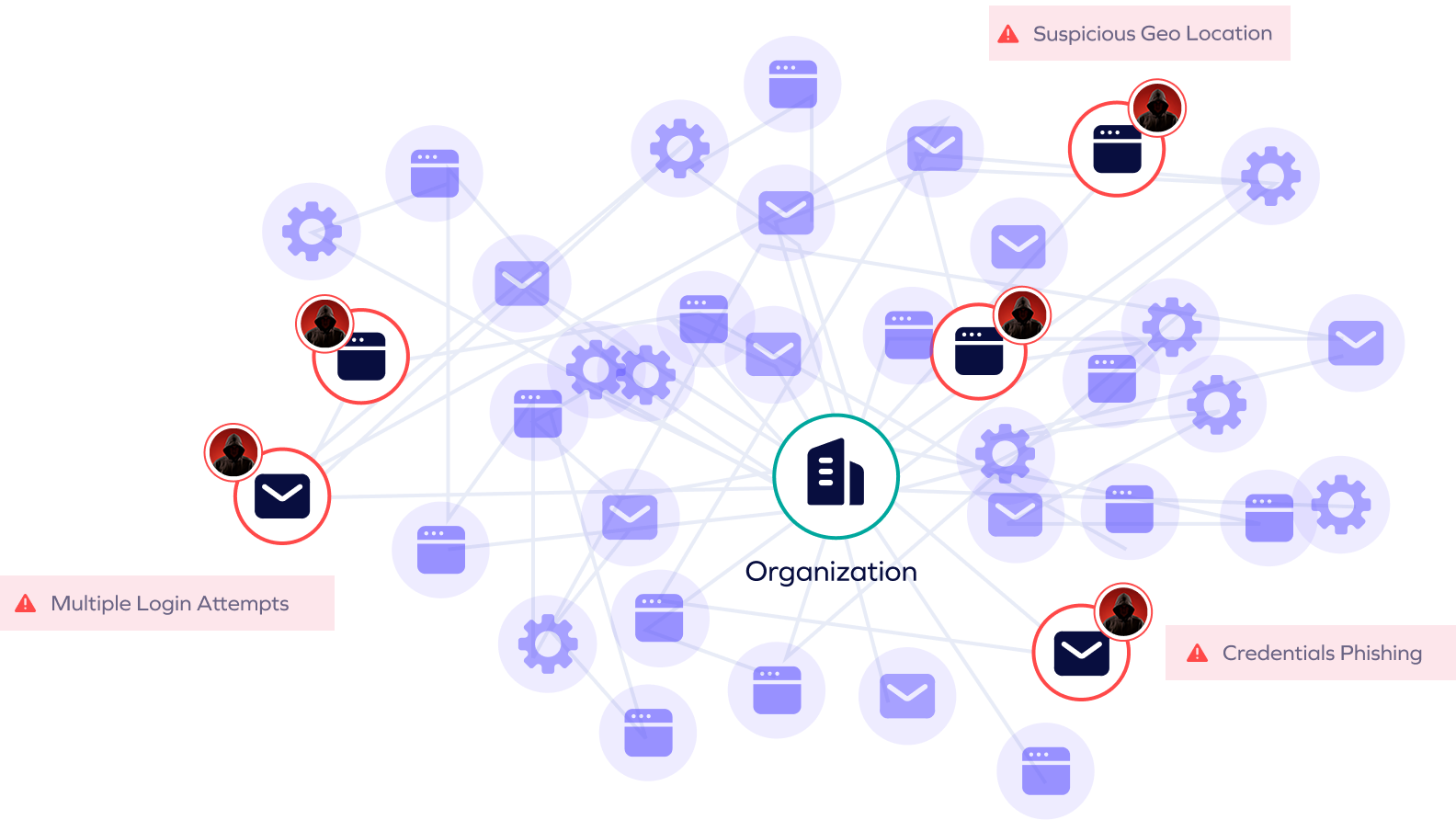

AI-powered attacks and advanced phishing schemes exploit weaknesses in authentication systems, allowing attackers to hijack accounts without triggering traditional security alerts. Without correlated data across security, IT, and finance teams, ATO threats remain hidden until it’s too late.

Attackers use automated tools and AI-driven credential stuffing to test massive volumes of stolen login credentials across multiple platforms. Without a unified view of login activity and anomalies, distinguishing between legitimate users and attackers becomes nearly impossible.

Siloed security tools and disjointed fraud prevention efforts create gaps that attackers easily exploit. Without real-time coordination between authentication, transaction monitoring, and identity verification, organizations struggle to proactively stop ATO before financial damage occurs.

THE SOLUTION

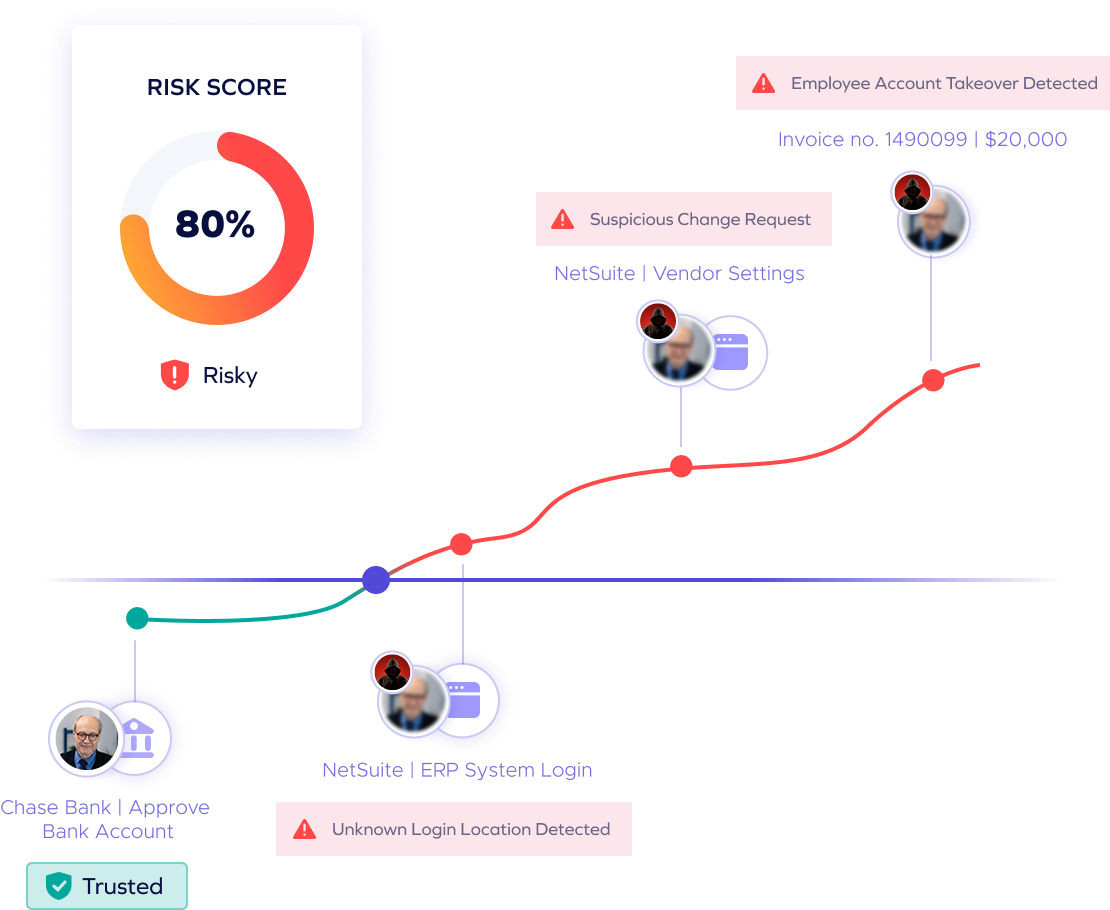

Leverages AI to identify suspicious changes in user behavior, account settings, and payment processes across ERP, email, and financial systems.

Continuously tracks login activity, transactions, and account modifications, triggering automated alerts for potential ATO threats.

Establishes a unique “digital fingerprint” for each user based on historical data, flagging deviations that indicate fraud.

our approach

Detect and Eliminate ATO Fraud Before it Strikes

Trustmi delivers a centralized, fully automated solution that safeguards the entire B2B payment lifecycle, proactively addressing the root cause of financial fraud—socially engineered cyberattacks—while reducing manual effort and errors.

Trustmi pulls data from various financial systems and combines it with other critical data points to validate transactions in real time, stopping fraud attempts stemming from social engineering before they cause harm.

Trustmi analyzes patterns across vendors, payment data, emails, and financial documents, detecting sophisticated social engineering tactics and ensuring holistic fraud detection beyond limited channels.

Trustmi seamlessly integrates with your payment ecosystem, ensuring uninterrupted operations while delivering robust protection against socially engineered cyberattacks targeting your payments.

Trusted by Finance and Security Leaders

"Trustmi provided transparency into our payment process to see where cyberattacks and errors were happening and full protection without changing our workflow."

"Like many businesses today, we've experienced cyber attacks on our payment process, but we didn't realize the extent to which we were at risk until we evaluated Trustmi. Now we're confident we'll be able to avoid future attacks with their platform."

"Trustmi's platform is an important tool for our team. Their Payment Flows module increases our payment cycle security, and our team has also managed to cut down the time for preparing payments reports from half a day to half an hour."